Copper is one of the most widely used metals in the world, and it plays an important role in various industries, such as construction, electronics, transportation, and renewable energy. Copper is also a key indicator of the global economic activity and sentiment, as it reflects the demand and supply of goods and services across different sectors and regions. That’s why understanding the dynamics and trends of the copper market is essential for investors and traders.

In this article, we will explore the current and future outlook of the copper market in Canada, one of the largest producers and consumers of copper in the world. We will examine the factors that influence the price movements of copper, such as the supply-demand balance, the geopolitical events, and the technological advancements. We will also provide real-time data and expert forecasts on the today’s copper price in Canada for the year 2024, and offer some key insights and analysis on the market.

Understanding Canada’s Copper Market

Canada stands tall as a major player in the global copper market, boasting the world’s 3rd largest reserves and 4th largest production of this vital metal. To understand its dynamics, it is necessary to take a deep dive into its meaning, pricing factors and complex inner workings.

Copper underpins various industries, from construction and electronics to renewable energy and electric vehicles. Canada’s production contributes significantly to global supply, impacting prices and influencing downstream industries worldwide.

Over 80% of Canada’s copper is exported, making it a crucial source for nations with strong demand and limited domestic resources. This export dependence ties the Canadian market closely to global economic trends and trade policies.

What Drives Copper Price?

We can consider from the point of view of internal and external influences:

External

- Global Demand: Booming demand from economies like China and India, coupled with the rise of renewable energy and infrastructure projects, exerts upward pressure on prices.

- Supply Chain Constraints: Mine development takes time, and unforeseen disruptions like strikes or environmental issues can limit supply, pushing prices higher.

- Canadian Dollar Fluctuations: A stronger Canadian dollar can make domestic copper exports less competitive globally, potentially affecting domestic prices.

- Government Policies: Policies related to mining, infrastructure development, and sustainability can influence exploration, production, and ultimately, prices.

Internal

- Market Consolidation: The Canadian market is dominated by a few large producers, leading to concentrated influence on prices and production decisions.

- Exploration and Development: Continued exploration and development of new copper deposits are crucial for sustaining production and addressing future demand.

- Environmental and Social Considerations: Environmental regulations, indigenous land rights, and community concerns play a significant role in mine development and impact the overall market landscape.

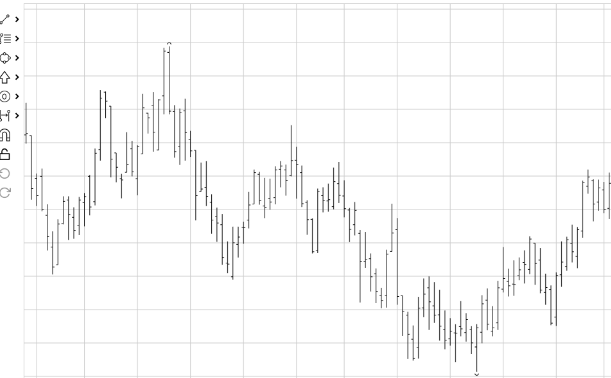

Current Copper Prices in Canada

Copper price in Canada reflects the real-time market conditions and expectations of the copper market, both domestically and internationally. The copper prices in Canada are determined by the interaction of the demand and supply forces in the market, as well as the exchange rate movements between the Canadian dollar and the US dollar, as copper is priced and traded in US dollars in the global market. The copper prices in Canada are also influenced by the market sentiment and speculation, as well as the market events and news, that affect the outlook and perception of the copper market.

Copper prices in Canada fluctuate depending on several factors, including the type of copper (scrap vs. virgin), quality, location, and global market forces. Here’s a breakdown of current copper prices and insights into influencing factors:

Price per Pound

- Scrap Copper: Prices typically range from CAD 4.20 to CAD 6.00 per pound depending on quality and type. Clean, bare bright copper fetches the highest price, while insulated or mixed grades sell for less.

- Virgin Copper: The current price of the Canadian Copper Benchmark (CCB), a reference price for electrolytic copper wire bars, is CAD 4.16 per pound.

Trends Over Time

- Scrap Copper: Prices have fluctuated slightly in recent months, but generally remained stable within the CAD 4-6 per pound range.

- Virgin Copper: The CCB price has seen more volatility, reaching a high of CAD 4.57 per pound in January 2024 before settling at its current level.

Scrap Copper Prices in Canada

The scrap copper market in Canada is an important part of the overall copper market, as it contributes to the supply and demand of copper, as well as the recycling and sustainability of copper. The scrap copper market in Canada involves the collection, processing, and trading of scrap copper, which is the copper that is discarded or recovered from various sources, such as industrial, commercial, or residential waste, or obsolete or damaged products or equipment. The scrap copper market in Canada provides an alternative and supplementary source of copper for the market, as well as a source of income and employment for the market participants.

Current Price Landscape:

- Varied Prices: Scrap copper prices in Canada fluctuate depending on type, quality, and local markets. Clean, bare bright copper commands the highest price, while insulated or mixed grades fetch less. Prices typically range from CAD 8.00 – CAD 11.50 per kilogram as of February 2024.

- Market Drivers: Global copper demand, supply constraints, and local factors like transportation costs influence scrap prices.

The current scrap copper price in Canada is also influenced by various factors, such as:

The Demand-Supply Dynamics: The demand-supply dynamics of scrap copper in Canada and the world affects the scrap copper price in Canada, as they reflect the attractiveness and competitiveness of scrap copper in the market. When the demand for scrap copper is high, the scrap copper price in Canada increases, as there is more demand for scrap copper as an alternative and supplementary source of copper, and the market participants are willing to pay higher prices.

The Recycling and Sustainability Efforts of Copper: The recycling and sustainability efforts of copper in Canada and the world affect the scrap copper price in Canada, as they affect the availability and quality of scrap copper in the market. When there are more recycling and sustainability efforts of copper, such as the collection and processing of scrap copper, its price in Canada decreases, as there is more supply and quality of scrap copper in the market, and the market participants are more aware and responsible.

Forecasting Copper Prices for 2024

Predicting copper prices in any specific region is complicated and subject to various uncertainties. However, we will provide you with insights from various expert forecasts and projections for copper prices in 2024.

Supply & Demand Dynamics

Supply: Global mine supply is expected to grow modestly in 2024, supported by Chinese expansion capacity. However, geopolitical tensions and permitting delays could disrupt production in some regions.

Demand: Demand from China, the world’s largest consumer, might remain subdued due to a potential slowdown in its economy. However, rising demand from other emerging markets and the green energy sector could offset this weakness.

Geopolitical Events

Tensions in major copper-producing countries like Chile and Peru could impact production and exports. Trade wars or sanctions could further disrupt supply chains and influence prices.

Technological Advancements:

- Development of new mining technologies could potentially increase efficiency and reduce costs.

- Advancements in battery technology for electric vehicles could impact copper demand patterns.

Expert Forecasts:

- BMI Research: Forecasts an average price of $8,800 per tonne in 2024, citing a weaker US dollar and supply concerns.

- S&P Global: Expects prices to remain volatile due to uncertainties surrounding global economic growth and demand.

- Nasdaq: Sees potential for prices to rebound above $4 per pound in 2024 due to a weaker dollar and interest rate movements.

We would recommendchecking out the Canadian Copper & Nickel Association (CANICA) and the Fraser Institute for more insights on the Canadian copper market.

Key Insights and Analysis

The Canadian copper market is full of opportunities driven by growing demand for renewable energy and infrastructure. But beneath the surface lie complex trends, patterns, and drivers that can impact both investors and industry players. Let’s look together at what awaits us in the copper market.

Trends

Growing demand: Copper demand is expected to rise, driven by factors like:

- Renewable energy: Copper is vital for solar panels, wind turbines, and electric vehicle infrastructure.

- Urbanization: Expanding cities require copper for construction and electrical grids.

- Technological advancements: 5G networks and other emerging technologies rely heavily on copper.

Supply constraints: Mine development takes time, and potential disruptions could limit supply growth.

Geopolitical factors: Trade tensions and evolving regulations can impact copper prices and supply chains.

ESG considerations: Environmental, social, and governance (ESG) factors are becoming increasingly important for investors and producers.

Copper Demand Drivers

Global economic growth: A strong global economy boosts demand for copper.

Government policies: Government support for renewable energy and infrastructure projects can drive copper demand.

Innovation: Technological advancements can create new uses for copper and improve production efficiency.

Insights for traders

- Copper demand is expected to grow due to megatrends like renewable energy and urbanization.

- Potential supply limitations could lead to higher copper prices.

- Investors and producers need to consider ESG factors to remain competitive.

- Investors should thoroughly research companies and projects before investing in the copper market.

- Keeping up with industry trends and developments is essential for making informed decisions.

Conclusion

The copper market in Canada is a complex market that requires a lot of skill, discipline, and knowledge to succeed. The copper market in Canada is influenced by various factors, both domestic and international, that affect the demand and supply of copper, as well as the value and quality of copper.

Copper market in Canada also offers various opportunities and challenges for the traders, as well as various tools and resources to facilitate and enhance your trading.

All the nuances and trends of the copper market in Canada, also strategies and techniques that we have discussed, will help you succeed in trading.

Good Luck!